Getting life insurance later in life is one of the most meaningful ways to protect your loved ones—especially if you want to spare them from financial burdens like funeral costs, medical bills, or outstanding debt. While seniors often face higher premiums and fewer policy options, the right coverage can still be affordable, strategic, and incredibly valuable.

This guide breaks down everything seniors need to know before buying life insurance: cost expectations, policy options, eligibility, and how to secure the best rates.

Key Takeaways

- Seniors typically pay higher premiums, but plenty of cost-effective options still exist.

- Common policies for seniors include term, whole, universal, burial, guaranteed issue, and simplified issue insurance.

- The right policy depends on your age, health, financial goals, and budget.

What Is Life Insurance for Seniors?

Life insurance for seniors functions exactly like standard coverage: you pay premiums, and your beneficiaries receive a tax-free death benefit when you pass away.

However, seniors may encounter:

- Higher rates, due to increased health risks.

- Fewer term options, especially after age 60.

- More underwriting hurdles, such as health questionnaires or medical exams (unless choosing simplified or guaranteed issue coverage).

Still, buying life insurance later in life can be extremely helpful—whether you want to protect your spouse, cover existing debt, or simply ensure your final expenses are taken care of.

Best Life Insurance Policies for Seniors

Choosing the right policy starts with identifying your goals. Below is a breakdown of the most common life insurance types for older adults.

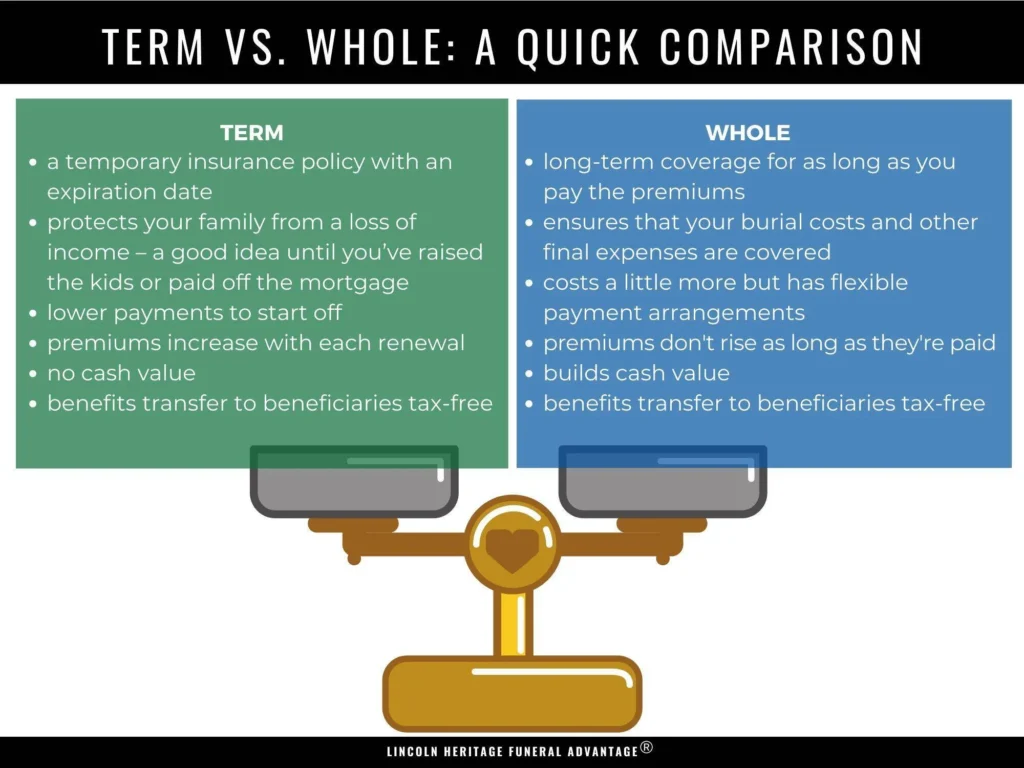

1. Term Life Insurance for Seniors

Best for:

✔ Healthy adults in their 50s–60s

✔ Seniors with temporary financial obligations

✔ Those seeking affordable, higher-coverage policies

Term life insurance is typically the lowest-cost option and provides coverage for a specific period (10, 15, 20, or sometimes 25 years).

Why seniors choose term life:

- Great for covering existing mortgages, loans, or income replacement.

- Lower premiums compared to whole life.

- Higher coverage amounts (often $100,000–$1,000,000+).

Important considerations:

- Coverage ends when the term expires.

- Limited availability after age 70.

- Medical exams are common, unless you choose simplified issue term.

2. Whole & Universal Life Insurance for Seniors

Best for:

✔ Seniors who want lifetime coverage

✔ Those planning to leave an inheritance

✔ Individuals with long-term financial goals

Whole and universal life insurance are permanent policies that never expire as long as premiums are paid.

Why seniors choose permanent coverage:

- Guaranteed death benefit.

- Accumulates cash value you can borrow or withdraw.

- Excellent for estate planning or leaving money behind.

What to keep in mind:

- More expensive than term life.

- Premiums must fit comfortably into your long-term retirement budget.

- Health questionnaires and medical exams are common.

3. Burial (Final Expense) Life Insurance

Best for:

✔ Seniors wanting simple, inexpensive coverage

✔ Those needing insurance primarily for funeral or final expenses

✔ Seniors with health issues

Burial insurance—also called final expense insurance—is a small whole life policy designed to pay for funeral costs, cremation, or minor outstanding bills.

Highlights:

- Coverage typically ranges from $2,500–$40,000.

- No expiration.

- Often requires no medical exam.

- Affordable and easy to qualify for.

4. Simplified Issue Life Insurance

Best for:

✔ Seniors with mild health issues

✔ Those who want faster approval

✔ Applicants avoiding medical exams

Simplified issue policies require:

- No medical exam

- A short health questionnaire

They offer quicker approvals but usually come with:

- Higher premiums

- Lower coverage limits

5. Guaranteed Issue Life Insurance

Best for:

✔ Seniors with serious health conditions

✔ Those denied for traditional policies

✔ Individuals who need guaranteed approval

Guaranteed issue policies require:

- No exam

- No health questions

- No medical records

Approval is automatic.

Considerations:

- Higher premiums

- Typically limited to $5,000–$25,000

- Often includes a two-year graded waiting period before full benefits apply

How to Get Life Insurance as a Senior

Here are the steps to secure the best coverage at the best rate:

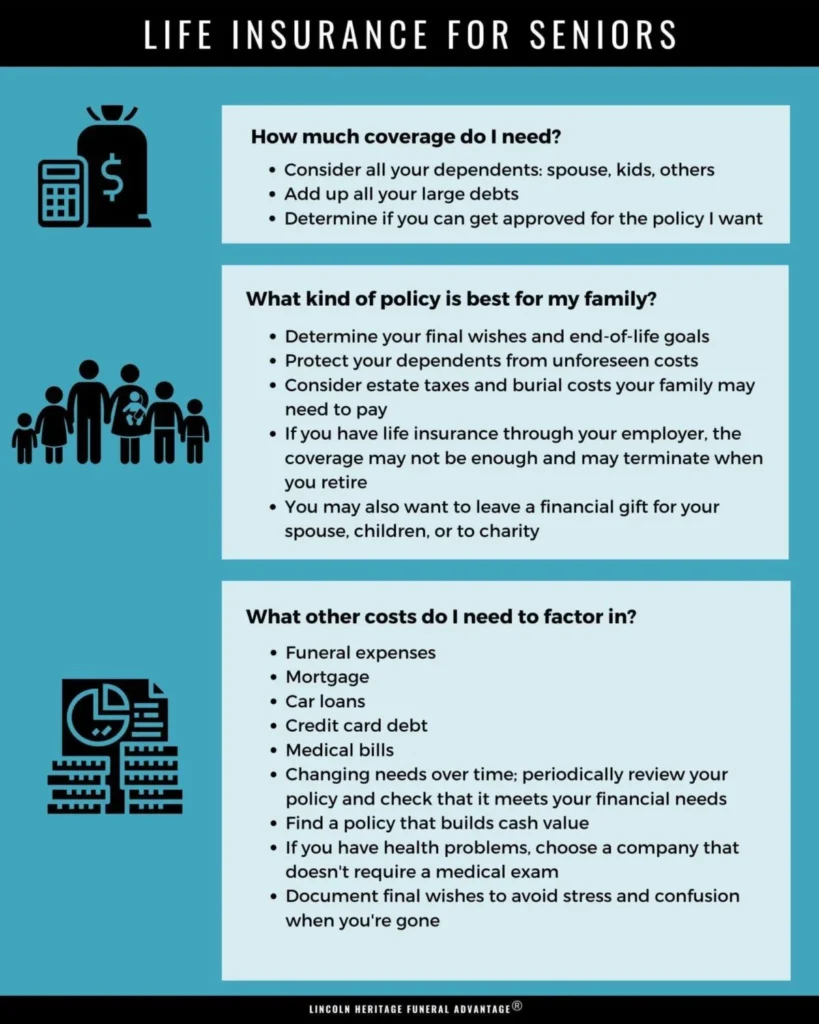

1. Evaluate your financial needs

Ask yourself:

- Do I want to cover final expenses only?

- Do I still have debt or a mortgage?

- Do I want to leave money behind for my family?

2. Review your health status

Your current health strongly impacts price and eligibility.

3. Compare multiple insurers

Rates vary widely among companies. Seniors benefit heavily from comparison shopping.

4. Choose the right policy type

Select term, whole, burial, simplified, or guaranteed issue based on your goals.

5. Apply and prepare for underwriting

You may need:

- A medical exam (unless choosing non-med or guaranteed issue)

- Basic health information

- Prescription history

How Much Does Life Insurance for Seniors Cost?

Premiums depend on:

- Age

- Gender

- Health

- Smoking habits

- Type of policy

- Coverage amount

Term life is cheapest, while guaranteed issue is usually the most expensive per dollar of coverage.

If you’d like, I can create a price comparison table based on your target audience.

Tips for Seniors to Get the Lowest Rates

- Apply as early as possible—even small age increases raise premiums.

- Improve health where possible (quit smoking, manage blood pressure, etc.).

- Compare quotes from at least three reputable insurers.

- Choose only the coverage amount you truly need.

- Consider burial or simplified issue policies if on a fixed income.

Final Thoughts

Life insurance for seniors is more accessible than most people realize. With flexible options—from term life to guaranteed issue policies—you can easily find a plan that protects your family’s future without stretching your budget.

Whether your goal is to cover funeral costs, eliminate debt, or leave a legacy, the right policy ensures your loved ones are financially secure long after you’re gone.

FAQ Section

1. What is the best life insurance for seniors?

The best life insurance for seniors depends on your age, health, and goals. Healthy seniors may benefit from term life insurance, while older adults or those with health issues often prefer whole life or guaranteed issue policies. Burial insurance is ideal for covering funeral costs.

2. Can seniors over 70 get life insurance?

Yes. Seniors over 70 can still qualify for life insurance, including burial insurance, simplified issue whole life, and guaranteed issue policies. Term life availability may be limited after age 70, depending on the insurer.

3. How much does life insurance cost for seniors?

Senior life insurance premiums vary based on age, gender, coverage type, and health. Term life may cost $30–$80/month for healthy seniors in their 60s, while burial insurance and guaranteed issue policies may range from $40–$150/month due to smaller coverage amounts.

4. Do seniors need a medical exam for life insurance?

Not always. Seniors can choose simplified issue policies that require no medical exam but include a health questionnaire. Guaranteed issue policies require no medical questions at all.

5. What is burial insurance for seniors?

Burial or final expense insurance is a small whole life policy—usually $5,000 to $40,000—designed to cover funeral expenses, cremation, and small debts. It offers easy approval and lifetime coverage.

6. Can I get life insurance if I have pre-existing health conditions?

Yes. Seniors with conditions like diabetes, high blood pressure, or heart issues can still qualify for simplified or guaranteed issue life insurance. These policies are easier to obtain but may have higher premiums.